In the digital age, it ought to be easy to gather data and present it well. But in recent years, producing annual reports has become increasingly pressurised.

The New Financial Reporting Landscape

Quarterly and annual reports are the most basic function of the finance department. And they’re getting harder every year.

Business is increasingly global; legislation varies wildly between jurisdictions; post-2008 rules are complex, ambiguous, and inconsistently applied (and, of course, can put CFOs in jail if they get things wrong).

The proportion of companies closing their books in five to six days has fallen since 2007 from 47% to 38%.

Despite this, expectations have gone through the roof. Your C-suite, board and shareholders don’t care that their demands are impossible. The smartphones in their pockets, the business dashboards on their SaaS solutions, and the Fitbits on their wrists have taught them that all data can be instant, accurate and actionable.

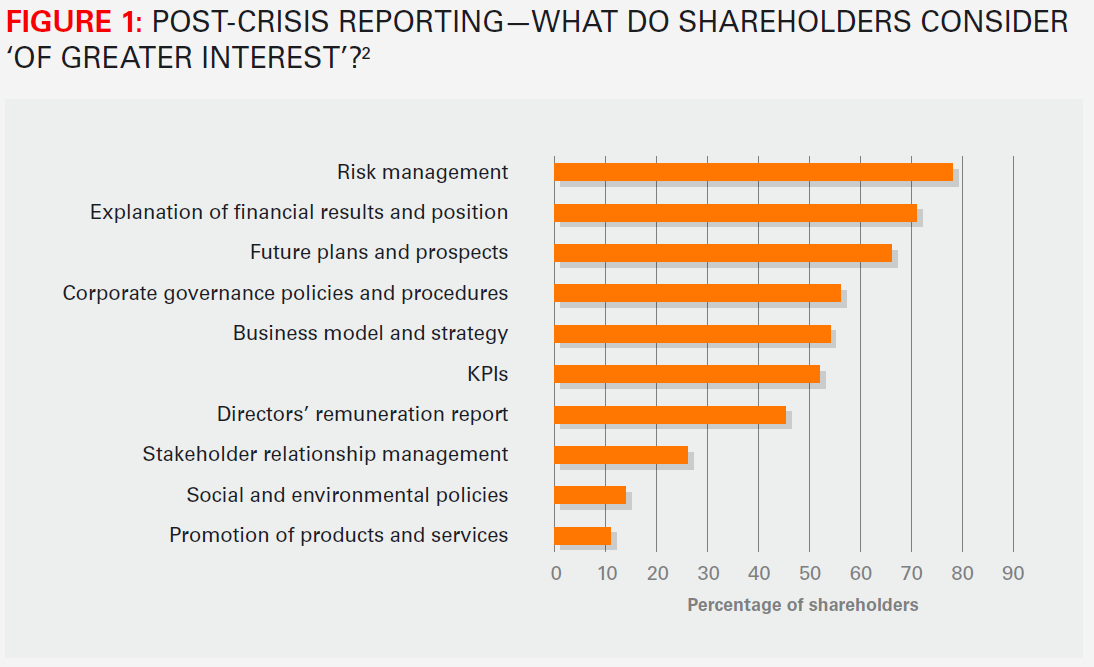

Not only that, but your shareholders want more and better disclosure. Building your reports around historical performance is no longer enough. They want better integration of everything from risk to governance and relationship management.

There are huge opportunities out there—but the expectations that have been created are even bigger.